Jenifer Starling Babu

Biomedical Science BSc

Hi! I’m Jeni, a second-year Biomedical Science student at the University of Huddersfield. I am originally from Lincoln, which is a couple hours away from Huddersfield.

Hi my name is Jeni I am currently a student at the University of Huddersfield.

As you know it can be quite tough handling and managing your money as a student. So I’m going to share my tips on how I budget and save money where I can.

First, I would suggest figuring out where your income comes from.

For most students this would be their maintenance loan from SFE (Student Finance England), a part-time job or parents’ allowance. I find it is better to split up where the money comes from, rather than just totalling it all.

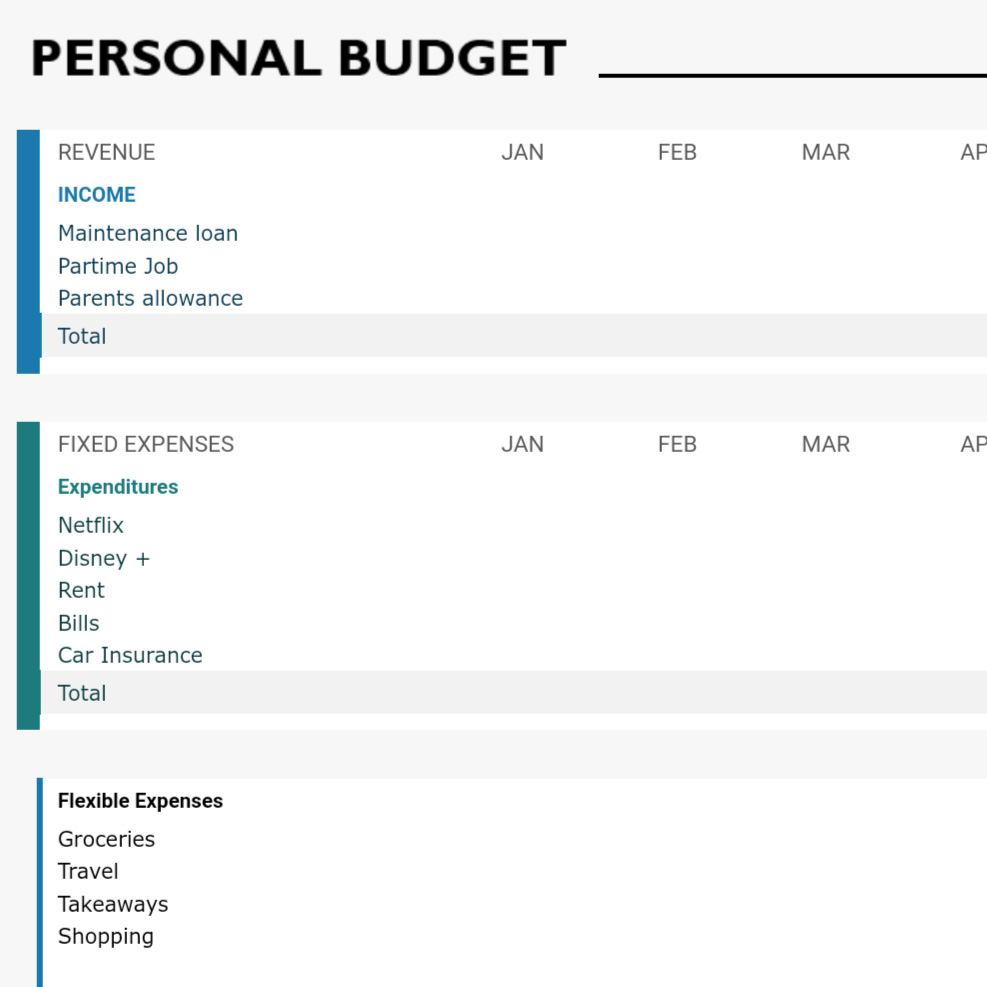

To monitor your spending I would suggest creating some sort of budget planner. This can be done on a piece of paper or an Excel spreadsheet. It might seem quite scary to set up a spreadsheet but it’s quite simple and once you’ve set it up its just a case of updating it and tracking your money.

Without having a visual tracker of your money it’s easier to spend money in instances where you don’t need to. It also may also help reduce your fears of spending as you’re more aware of how much is coming in and going out.

Before setting up my own budget plan, I used to be scared of spending my money because I felt I was spending too much. Even in instances where it was a necessary purchase I would try talking myself out of it. But now I have a weekly budget plus extra expenses so I know exactly how much I can spend per week in order to maintain my savings, but also track if I did go over my budget once in a while and be able to maintain the expenditure.

To set up an Excel word sheet, you just need four main categories.

- Monthly income: this is where your incomes is coming from, so maintenance loan, personal savings, job, parents’ allowance etc.

- Fixed Monthly Expenses: this is expenses that come up every month/term - things like monthly subscriptions, bills, rent, insurance.

- Flexible Monthly Expenses: this is anything with no fixed amount of money being spent. Such as groceries, travel, nights out, clothing, takeaways etc.

- Monthly savings: this is how much you want to put aside each month

Now all you have to do is input how much money you get per month, subtract all your fixed expenses and you should be left with a certain amount each month.

Next, calculate how much you want to put aside each month for personal saving, so for me right now that’s saving up to buy a car. With what you’re left with, try budgeting that on your flexible expenses.

If you’re struggling to make an Excel sheet on your own, there are loads of free downloadable options available online. All you have to do is download the template and input your income and expenses.

A short example of a budgeting sheet

A short example of a budgeting sheetNow, onto actually saving money where you can so you a have a little extra left:

Groceries:

Meal prepping or meal planning can be really helpful as it can reduce impulse buying. If you have a grocery list with you, you know exactly what to get. I would personally recommend buying own brands such as Tesco’s essentials or Asda’s Just Essentials. They’re often much cheaper to buy than branded goods.

I've found doing meal prep helps keep me on budget with my food spend.

I've found doing meal prep helps keep me on budget with my food spend.Travelling:

If you’re a commuter or simply travelling often in general on train, I highly suggest investing in a Railcard. They’re (currently) £30 for one year, or £70 for three years, and they’re such a money saver. I often travel back home for the weekends and my Railcard saves me around half price. A ticket that would be £14 can be as low as £7 depending on the time.

A railcard is an absolute must!

A railcard is an absolute must!Student Discounts:

UNiDAYS, Save the Student and Student Beans are worth signing up to. They have loads of discount codes for websites where you can get up to 10 per cent off clothes and more, plus they even have discounts on restaurants.

Other websites have student exclusive discounts like boohoo which offers next-day free delivery when you sign up using your uni email. It’s great for last-minute shopping for clothes for a night out, so you’re not having to spend extra on delivery.

Save the student really living up to its name!

Save the student really living up to its name!Coupons/Reward Programs:

Coupons are an easy way to save money. They have many offers like buy one get one half price, buy three for the price of two. It’s a simple way to save a few pennies on your shop.

Shops also do rewards schemes such as Tesco Clubcard and Asda Rewards. All you have to do is sign-up and collect points by scanning your card before a purchase. Boots and Superdrug also do rewards cards. Makeup and Skincare are some of my biggest flexible expenses and so I use a Superdrug rewards card.

Second Hand Goods/ Thrifting:

Sometimes at uni you might need to buy textbooks or equipment and buying them brand new can be expensive. Some of the science books I need cost up to £30 but I looked online and managed to buy them second-hand for much less.

You could also thrift clothes and other items as well. Depop has many people reselling clothes at a reasonable price and even eBay opened a clothes-selling program where you could buy second-hand. Especially if it’s something specific you’re looking to purchase.

Student Life

Discover more blogs and article that revolve around the student experience in Huddersfield

Which University?

If you're still unsure which university to choose then there are more articles by students about how they chose their course and university.